https://www.colvin-law.com/disability-denial/

https://www.guajardomarks.com/2018/12/26/what-constitutes-a-drunk-driving-accident/

https://www.guajardomarks.com/2018/01/12/construction-work-accidents/

Just another WordPress site

Thank you for stopping by! I am a highly experienced, Texas-based copywriter with approximately 15 years of experience writing in education, real estate, mortgages and finance, healthcare and personal injury. I also have several ghostwritten articles published on Inman News under the name John Majalca. These are links to 2019 and 2020 samples of my copywriting:

Rates generally are .04 to .06 per word, depending on volume, research involved and type of content. Please contact me at jmpickett at gmail dot com.

This is a February 2019 article that went viral around the world. It is from the site Weedkillercrisis.com. My editor does not want a direct link to it, so I produced the article in full below.

Monsanto’s weedkiller Roundup has been one of the most popular pesticides around the world since the 1970s; in fact, it is the most widely used pesticide ever. Roundup is used heavily in agriculture for many of the most popular crops, and also is used by millions of consumers on their gardens at home.

However, its key ingredient – glyphosate – has been at the center of a firestorm of controversy that is getting more intense by the year. More crops are genetically modified to be tolerant of glyphosate, leading to higher yields for giant agriculture companies. But the chemical has been found to cause a variety of serious health problems, including the deadly cancer Non-Hodgkin’s lymphoma.

Let’s take a dive into this report now.

In an ironic twist, glyphosate has been shown to be toxic to the liver in basic, phase one detoxification processes involving the cytochrome pathways. It is alarming that one of the most toxic chemicals in the world can actually impair human detoxification processes. So, the toxic chemical glyphosate actually makes it more difficult to detox.

Before we explore the myriad of diseases and illness on the rise, let’s look at where and how it’s used.

Sourced directly from the United States Geological Survey, this graphic shows the estimated annual agricultural pesticide use for glyphosate for the latest reported year of 2016.

The total amount of glyphosate applied to corn, soybeans, wheat, cotton, vegetables and fruit, rice, orchards and grapes, alfalfa, pasture and hay and other crops. Use amounts are measured in millions of pounds. (Source ResearchGate.net)

Allergies and autoimmune illnesses are becoming so common today that it is easy to forget they could be signals of immunity failure. They may affect the ability of our bodies to optimize health. The higher number of allergies being seen in the human population could be an indicator that harmful substances are invading our bodies. People who suffer from allergies, autoimmune diseases, diabetes and other serious illnesses could be a ‘canary in the coal mine’ for the rest of us.

Let’s take a look at the most recently studied health problems correlated with glyphosate usage around the country.

Used Roundup Weedkiller? Have Cancer?

The following associated charts are courtesy of Researchgate.net, a professional network for scientists and researchers.

In This Section

Alzheimer’s disease is the most common type of dementia. Over time, people who develop this disease lose most of their memory, cannot concentrate, and can no longer perform the common daily functions of living.

The following chart shows the correlation between deaths due to Alzheimer’s disease and glyphosate applications to corn and soy crops. Data discontinuity between 1998 and 1999 has been removed by subtracting a constant from 1999-2010 data points. Discontinuity arises in some data because of the ICD code change from the ninth revision to the tenth (ICD-9, ICD-10). (Source ResearchGate.net)

Autism spectrum disorder or ASD is a type of neurodevelopmental disorder that features deficits in social communication and social interaction. It also presents restricted and repetitive behaviors that make it difficult for the person to interact normally with other people.

The following chart shows the correlation between autism prevalence, from hospital discharge data, and glyphosate applications to corn and soy crops. (Source ResearchGate.net)

Attention-deficit/hyperactivity disorder or ADHD is a disorder of the brain that is marked by a regular pattern of inattention and often hyperactivity and impulsivity that can interfere with a child’s development and overall cognitive function.

The following chart shows the correlation between ADHD prevalence and glyphosate applications to corn and soy crops. (Source ResearchGate.net)

Anxiety is a feeling of worry, nervousness or unease that all humans feel from time to time. But anxiety disorder is a serious medical condition that can cause people to have serious physical and psychological symptoms, including sweating, rapid heartbeat, dizziness, nausea and shortness of breath.

The following chart shows the correlation between anxiety prevalence and glyphosate applications to corn and soy crops. (Source ResearchGate.net)

Breast cancer means malignant tumors are forming in the tissue of one or both breasts. Some of the common symptoms of breast cancer is a breast lump, change in the size and shape of the breast, nipple drainage, skin dimples in the breast and red patches on the breast(s).

The following chart shows the Incidence of breast cancer in US hospital discharge data from 1998 to 2010 normalized to counts per 1,000,000 population each year, after subtraction of an exponential model accounting for the decline in the years up to 2006 in the Caucasian subpopulation [see text]. This includes all reports of ICD-9 codes 174 and 175. The red line shows trends in glyphosate usage on corn and soy crops over the same time period. (Source ResearchGate.net)

![Incidence of breast cancer in US hospital discharge data from 1998 to 2010 normalized to counts per 1,000,000 population each year, after subtraction of an exponential model accounting for the decline in the years up to 2006 in the Caucasian subpopulation [see text]. This includes all reports of ICD-9 codes 174 and 175. The red line shows trends in glyphosate usage on corn and soy crops over the same time period.](https://www.researchgate.net/profile/Anthony_Samsel/publication/283490944/figure/fig3/AS:292152778215425@1446666058102/Incidence-of-breast-cancer-in-US-hospital-discharge-data-from-1998-to-2010-normalized-to.png)

Celiac disease is an autoimmune disorder that can happen to people who are genetically more likely to get the condition. It occurs when ingesting gluten damages the small intestine. It is thought to affect millions of people around the world. When people with this disease eat gluten, the body attacks the small intestine in a strong immune response. Such attacks damage the villi, or tiny, fingerlike projections that line the organ.

The following chart shows the correlation between increase in celiac disease (gluten intolerance) and increase in use of the herbicide glyphosate (Roundup ® ) on genetically modified grain (Samsel &Seneff, 2013). (Source ResearchGate.net)

Ulcerative colitis is a chronic disease that causes serious inflammation, including irritation, swelling, and sores on the inside lining of the small intestine. Ulcerative colitis usually begins slowly and can get worse over months and years. Symptoms can vary from mild to severe. Many people have long periods of remission that can last for weeks, months, or years.

The following chart shows the Correlation between inflammatory bowel disease and glyphosate applications to US corn and soy crops. (Source ResearchGate.net)

Dementia is a general name for any disorder or disease that causes a major change in memory or cognitive abilities. Dementia is severe enough to damage the person’s daily ability to function, such as drive, shop, eat, dress, work and communicate. The most common type of dementia is Alzheimer’s disease, but there are other forms, such as Parkinson’s Disease dementia, Huntington’s disease and family prion disease.

The following chart shows the correlation between dementia prevalence and glyphosate applications to corn and soy crops. (Source ResearchGate.net)

Diabetes is a metabolism disorder. Metabolism refers to the way the body digests food for energy and growth. Most foods we eat are broken down into a basic form of sugar called glucose; this is the major fuel source of the body. Insulin is produced by the pancreas to transfer glucose from blood to the cells. With diabetes, cells fail to respond properly to insulin produced by the body.

The following chart shows the correlation between age-adjusted diabetes prevalence and glyphosate applications and percentage of US corn and soy crops that are GE. (Source ResearchGate.net)

Fatty liver disease is also called non-alcoholic steatohepatitis, known as NASH. With the rise of the obesity epidemic, it causes scarring and inflammation leading to cirrhosis, cardiac and lung complications, cancer and death.

The following chart shows the correlation between age-adjusted liver cancer incidence and glyphosate applications and percentage of US corn and soy crops that are GE. (Source ResearchGate.net)

Obesity is one of the most preventable and leading causes of death in the United States. Obesity is a serious chronic disease that can seriously damage health, including heart disease, diabetes, joint problems and more.

The following chart shows the correlation between age-adjusted obesity deaths and glyphosate applications and percentage of US corn and soy crops that are GE. (Source ResearchGate.net)

Kidney failure is also called end-stage renal disease or ESRD. It is the final stage of chronic kidney disease, and it is generally caused by many other serious health problems that have damaged the kidneys over the years. Early stages of kidney disease may not even be noticed by the person.

The following chart shows the correlation between age-adjusted kidney cancer incidence and glyphosate applications and percentage of US corn and soy crops that are GE. (Source ResearchGate.net)

Thyroid cancer develops in the thyroid gland. This gland has a butterfly shape in the front of the neck, under the Adam’s apple. It wraps around the front of the windpipe. This gland is part of the endocrine system and produces and controls important hormones.

The following chart shows the plots of glyphosate usage on corn and soy crops (blue), percent of corn and soy that is genetically engineered to be “Roundup Ready” (red), and incidence of thyroid cancer (yellow bars) in the US. (Figure courtesy of Dr. Nancy Swanson) (Source ResearchGate.net)

Scientific evidence is rapidly growing that indicates glyphosate in the Roundup formulation leads to many serious health problems. Giving that this toxic chemical can cause diseases from cancer to dementia to autism, isn’t it time for more to be done to eliminate the use of glyphosate in agriculture? Where are the alternatives? Why hasn’t the EPA re-classified it as a human carcinogen?

As of this writing, at least 13 countries, including Germany and Belgium, have introduced legislation to limit or ban the use of glyphosate. More countries are considering it. However, in the US, the EPA continues to give the green light to glyphosate and Roundup use. Perhaps as more scientific evidence is revealed about the dangers of this chemical, the tide will turn against Monsanto and Roundup even in the United States, but in the meantime, we’ll have to wait and see.

A California jury found unanimously today that Monsanto is liable for failing to provide adequate warnings that its bestselling Roundup weedkiller could cause non-Hodgkins lymphoma (NHA) and other cancers. The federal jury awarded a California man more than $80 million, and delivered a devastating blow to Monsanto and its parent company Bayer AG, in the first bellwether trial. (Law360.com)

After only a day of deliberations, the jury of five women and one man determined that Monsanto was liable for a negligence claim, a design defect claim and a failure to warn claim. The jury decided to award Ed Hardeman, 70, $200,967 in economic damages, $5 million in future and past noneconomic damages, and a stunning $75 million in punitive damages. (Ewg.org)

The huge verdict in favor of the plaintiff Hardeman marks the end of a month-long, two-part federal trial over allegations that decades of Hardeman using Roundup on his Santa Rosa, California property led to his NHA. The first part of the weedkiller trial concluded March 19. The jury decided Roundup was a major factor in causing his cancer. This sent the case into the second phase to determine what the liability and damages would be.

During part two, the jury listened to evidence that from 1980 to 2012, Monsanto had knowledge of five epidemiological studies, seven studies involving animals, three oxidative stress studies and 14 genotoxicity clinical studies that showed a connection between Roundup and cancer. Hardeman’s attorney, Jennifer Ann Moore, stated during closing arguments that despite the overwhelming clinical evidence, Monsanto never provided any warnings to consumers. The company also declined to do its own long term research on the cancer dangers of Roundup.

Moore also made accusations against Monsanto executives, saying that they ghost-wrote several white papers in the 1990s and 2000s to allegedly mislead federal officials and regulators and consumers about the safety of Roundup. She requested the jury award punitive damages against the company for ‘manipulating the science’ and the opinion of the public for years. She pointed out that Bayer purchased Monsanto for $63 billion in June 2018, and that the company made a profit of $210 million from sales of Roundup in only one year.

In defense of Monsanto, roundup lawsuit attorney Brian Stekloff argued that the active ingredient in the weedkiller, glyphosate, has been studied in incredible detail for decades. Until recently, no regulatory body or health organization ever determined glyphosate could cause any type of cancer, including non-Hodgkins lymphoma.

Defense counsel also stated that to hand out punitive damages, the jury must believe that Monsanto’s executives and other employees committed crimes and lied about the safety of the product. But, Stekloff argued, Monsanto’s employees backed the safety profile of Roundup. They all testified that they use the popular weedkiller at home and do not use any protection.

Stekloff also said that even if Monsanto needed to provide a warning to consumers about risks of cancer, there is no convincing evidence that Hardeman even would have read the label.

But on this day, the jury took the side of the plaintiff and laid a crushing blow on Monsanto.

In response, Bayer has said that it will appeal the verdict. Their press statement noted that Bayer still stands behind Roundup and will continue to mount a strong defense.

The Santa Rosa man’s roundup cancer lawsuit was the first Roundup case to go to the trial phase, out of hundreds of related lawsuits that still are pending in the Northern District of California over allegations of cancer involving Roundup and Ranger Pro. As of January 2019, almost 700 Roundup product liability cases were consolidated in the court of US District Judge Vince Chhabria.

The next case regarding Roundup that will go to trial is Pilliod v. Monsanto. This trial will begin tomorrow in California state court in Oakland. Another bellwether trial in the federal MDL will begin May 20. But Judge Chhabria stated during a hearing in early 2019 that he will probably pause federal litigation after the verdict for Pilliod comes down. This will allow both parties to consider a settlement.

The Hardeman trial and its $80 million verdict came after a California state jury slammed Monsanto last year with a $289 million verdict. It was later reduced by the judge to $78 million. In that Roundup case, former school groundskeeper Dewayne Johnson claimed he got NHL from spraying at least 150 gallons of Ranger Pro with little safety gear on five school campuses for many years. That verdict is in appeal.

Together, both verdicts at the federal and state levels set a very strong precedent for the thousands of other cases that are pending. There currently are at least 11,000 lawsuits the company is facing, claiming that long term exposure to glyphosate in Roundup and other products caused cancer.

In 2015, WHO’s International Agency for Research on Cancer (IARC) stated that glyphosate is probably carcinogenic to humans. But the EPA concluded that the pesticide was probably not dangerous to humans. Nonetheless, the major verdicts against Monsanto and Bayer are going to make a persuasive argument to consumers that the products are dangerous to people, and this could have a major effect on the bottom lines for both companies. (Buzzfeednews.com)

Still, products that are based upon glyphosate are still legal in the US. But several cities and communities across America are taken their own steps to ban the use of Roundup and related pesticides. Also, in 2017, California promulgated a warning about glyphosate, and added it to a list of chemicals known to cause cancer, although this decision was reversed by a state judge later.

References

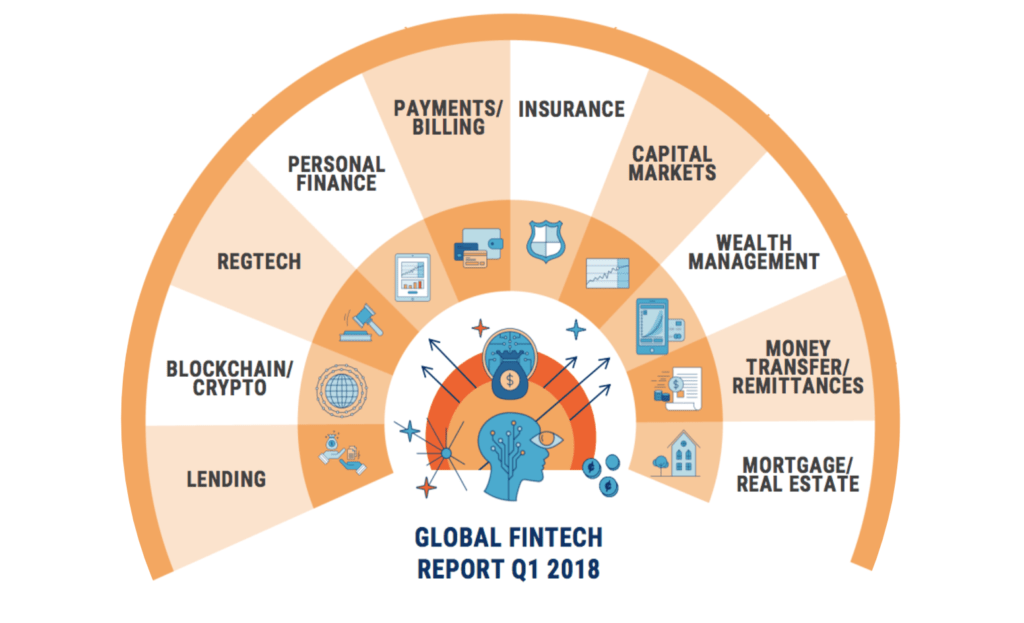

10 Best FINTECH Careers and Jobs for the Future

If you are interested in a finance career these days, you probably know about FINTECH, which is defined as the evolving intersection of technology and financial services. These are companies that are able to leverage new technology to create new, better financial services for consumers and businesses. FINTECH can include all sorts of companies that may operate in insurance, payments, asset management

FINTECH is technology that is used in financial services to help firms to manage various financial aspects of their business, such as new software, applications, processes and business models.

“I think the biggest change is that people are going to receive financial help before they even know it. It’s a combination of big data and artificial intelligence. We’re going to be able to be more intelligent about people’s spending habits, their health, their lifestyles. [We’re] going to get more effective at predicting what they’re going to need for different scenarios of spending and saving – when people are likely to get married, when you are likely to have a baby, etc….” (WIRED Money 2017 speaker Nick Hungerford, CEO of Nutmeg)

FINTECHs are largely start-ups that are in direct competition with traditional financial and banking institutions, and in some respects took them by surprise. Today, FINTECH operates in dozens of countries, and are slowly taken over small chunks of the financial services industry to provide financial products and services that were once only available through large financial institutions.

First off let’s understand the technologies behind what powers FINTECH.

Artificial intelligence and new sorts of distributed ledgers, including blockchain, are the most important emerging FINTECH technologies. About 30% of large financial organizations are putting money into AI.

According to ZDNet.com, 60% of C-level executives in a recent survey conducted by Constellation Research said they will be increasing investment in AI in 2018 by 50% than in previous years.

Regarding blockchain, PWC has found that 75% of financial services firms intend to adopt blockchain as part of their in production systems and processes by 2020. But this is the big boys only playing catch up. FINTECH companies have offered AI, blockchain and cryptocurrency solutions to the public for years.

The following chart from CBInsights (Global Fintech Report Q1 2018) is a data-driven look at global financial technology investment trends, top deals, active investors, and corporate activity.

Because FINTECH is becoming so popular and part of the financial services industry, there are many tantalizing career options in the field for finance students and professionals to consider.

Because the main drivers of FINTECH are AI and blockchain, you’ll see a number of jobs and degree options in these areas:

This growth will greatly increase the need for blockchain experts, such as blockchain developers.

According to Hacknoon.com, requests for block chain programming talent are soaring. According to the freelance talent marketplace Upwork, blockchain rose to one of the fastest growing skills ouf of more than 5000, and there was a year over year increase of more than 35,000%.

Interested in becoming a blockchain developer? You should learn these programming skills:

The FINTECH apps market has seen spectacular growth over the last several years. Global app downloads and consumer spending have been hitting record levels, according to recent reports. The demand for mobile payment solutions and personal finance is only growing, as it is being driven by an appetite from younger generations of tech-savvy consumers.

Millennials also are more likely to use their increased ability to make payments securely on their phones.

Visa has reported more than ⅓ of users made a peer to peer digital payment over a mobile device, and ⅗ have sent money to family with a mobile device.

There will be a stronger need in future years for financial technology app developers to serve this booming market.

A financial analyst is responsible for managing budgets against incoming income forecasts. Depending upon the size of the firm, you could be an analyst for a single division or the entire company. Financial analysts assemble financial reports and do forecasts of incoming revenue, as well as run business studies. See full financial analyst salary outlook.

Financial analyst jobs in FINTECH are in great demand as startups continue to grow.

These new financial services businesses need financial analysts to manage their revenue, but they also need new graduates to work with clients to analyze the data through the use of whatever startup or tool the company has built.

Demand in this field is only going to grow, as venture capital funding in FINTECH hit $13.6 billion in 2016.

Product managers are now regularly needed to handle the oversight of many FINTECH products. For example, a listing on Linkedin.com has an opening for a Senior Product Manager for a well funded blockchain startup that works in the data security space. Product management work dovetails with initiatives in cryptography, encryption, online identity and security.

The product manager will design, architect, and develop a decentralized blockchain network that allows strong data security, strong control of data, easy integration, creation of new profit centers and reduction of cost.

Skills are needed in Agile and Scrum, as well as three years of experience as a technical product manager. See full salary outlook for product manager.

As the regulatory burden in FINTECH grows, there will be more compliance experts, compliance officers, and compliance analysts working in these financial companies.

In fact, the major area in finance that has seen steady job growth since the financial crisis has been in compliance, legal and risk areas, Reuters says.

The Wall Street Journal has even wrote that compliance officer is one of the hottest jobs in the country. See 5+ best compliance management degree programs.

Online thieves and hackers always go where the money is. Financial services will always be a major target. According to research from IBM’s X-Force research team, the financial services industry has been attacked more than any industry since 2016. But the cyberskills security gap is large and growing. See 5+ best Cybersecurity degree programs.

A report by Cybersecurity Ventures recently estimated that cyber crimes will be triple the number of job openings in the next five years. There also will be at least 3.5 million unfilled cybersecurity positions by 2021.

Demand is red hot for these workers in FINTECH.

‘Quants’ are the smart people who write the big, complex financial models. They are the ones behind the data-driving trading technology that large investment banks and hedge funds use to trade securities and analyze risk. As big data continues to rise, quants are becoming more important in FINTECH to devise models that can sort through the massive amount of data and automate them so that trading can be a mostly automatic process. See 5+ best quantitative analysis degree programs.

The Wall Street Journal recently wrote that the quants now run Wall Street. There are so much in demand that their compensation packages can be as high as $500,000 per year.

These math, computing and finance experts are also sought by FINTECH companies; quantum computing is important to develop the algorithms of the future.

Sure, this sounds like a feel good job title, but for FINTECH firms, a positive, innovative and entrepreneurial image is important to success as their employees are the best advertisement for their brand. FINTECHs must ensure all workers are happy and fulfilled.

Keeping talent is so important because hiring the most skilled candidates in the biggest expense of the FINTECH, but also is vital to future development. HR champions and culture evangelists who can build and maintain a diverse workplace will be in great demand.

Business development managers are very important in FINTECH organizations because they help to generate new income and help many startup companies to grow. Business development managers look for new markets, new business partnerships, and new ways to tap existing markets. See full salary outlook for business development managers.

Business development managers also:

Deloitte recently highlighted the important strategic role of data in a report with the World Economic Forum about trends affecting the financial services industry. Innovation that emerges will allow financial companies to have access to new sets of data, including social data, and allow new ways to understand markets and customers. See 5+ best data analytics degree programs.

As clients are more empowered by the Internet and digital technologies, clients are becoming more proactive and want new financial services companies to give them more individual services tailored to their needs. So, there will be a need for data scientists, chief data officers, financial data analysts and data analytics managersneeded to sift through information that can provide more insights into their markets.

If you want to position yourself to be recruited for a lucrative FINTECH job, below are the most popular technology skills searched for by recruiters in the eFinancialCareers CV database:

So who is hiring in FINTECH? The question is more like, who is NOT hiring? A brief review of open FINTECH jobs listed on Indeed.com reveal companies hiring for these positions:

FINTECH is a rapidly growing space that most students and professionals will want to learn more about in the future, as so many high-paying jobs are going to be in this sector.

9 Best Blockchain Careers and Jobs to Get for 2019

2018 was a mixed year for blockchain technologies. The star of the show, cryptocurrency, saw a huge decline in value, with crypto’s total market capitalization shedding more than three-quarters of its value over the course of the year. Add to that uncertainty over legal and regulatory hurdles to blockchain adoption, and you could be forgiven for thinking 2018 was a bad year for the technology.

If it was supposed to be a bad year, someone forgot to tell blockchain hiring managers and recruiters, as hiring sites saw huge surges in openings for blockchain- and crypto-related jobs. Glassdoor saw a 300 percent jump between August 2017 and August 2018.

So for those eager to start or advance a career in blockchain, you don’t need to worry that the moment has passed you by. Whether you’re an engineer, designer or developer or you fill a business-related role, there’s no doubt you should consider a career in blockchain in 2019 if the promise of this emerging technology is something you find exciting.

2018 was tough for cryptocurrencies’ value, but a look at the broader data reveals a more complex story. Let’s take a closer look:

Total value

Barriers to adoption

What’s keeping companies from using blockchain technologies? According to a PwC Global survey, the top concerns are:

A big bright spot

Despite a bumpy 2018, 2019 looks to be a banner year for jobs in blockchain, and here are nine of the best jobs to consider, which companies and industries are hiring and what salary levels you could expect to see when you hit the job market.

While each job and company are unique, several technologies and skill sets are common across all hands-on technology roles at blockchain companies, and even if you’re not typing code all day, it’s helpful to understand the basics of the underlying technology. Here’s a look at some of what you’ll likely need to know:

Tools & languages

Broad skills & traits

As we already mentioned, just because you’re not a hot-shot engineer or developer doesn’t mean you can’t get in on the blockchain job boom, as some of these jobs prove.

Any company investing in blockchain needs software engineers, making this job by far the most in-demand among all companies hiring. Specific duties will vary according to the industry and how developed the company’s existing technology is, but experience in ledger technologies like Solidity and HyperLedger Fabric, as well as database, programming, cloud and other languages will be required.

Most companies are seeking individuals with at least undergraduate degrees in computer science, computer engineering or other engineering degrees, especially for high-paying senior roles.

Popular industries include currencies, of course, but also smart contracts, regulatory technology, banking and others.

Salary range

Who’s hiring

A role that requires technical expertise but also a strong dose of the human touch, blockchain technology architects are responsible for end-to-end implementation of blockchain solutions. Technology architects participate in broad discussions on what and how technologies will be implemented and often serve as the company’s representative to customers.

Knowledge of and experience in the programming languages needed to produce blockchain applications are needed, and computer science degrees are generally required for senior roles.

Popular industries include cloud and web services, cryptocurrency and business services.

Salary range

Who’s hiring

These individuals lead all aspects of design and development of blockchain applications across multiple teams, ensuring products are delivered on time and in budget. Hands-on programming experience is generally not required, but knowledge of languages and programs used is helpful. Experience with project timelines and budgets isrequired.

Required education varies widely depending on the specific products developed at each company, but generally, successful candidates will have at least bachelor’s degrees a technology- or management-related field.

Industries include advertising and media, cryptocurrency and banking.

Salary range

Who’s hiring

Ensuring compliance with local, state and federal regulations, a blockchain risk analyst’s daily job will vary depending on the industry and how developed their employer’s technology is, but they could be aiding in programming and development, conducting data analysis or maintaining documentation on products and technologies.

The required education will depend entirely on the specifics of the job, but risk analysts interested in careers in blockchain should have a strong grasp on the technology and specific programming languages used to build blockchain applications.

Most risk analyst jobs in blockchain will be in finance- and government-related industries.

Salary range

Who’s hiring

Primarily a media communications role, an analyst relations manager at a blockchain company helps position the company and its technology the company’s broad industry and the market at large. This person is responsible for ensuring that analysts within the industry are aware of their employer’s technology and consider it a viable and positive option for their own companies or clients.

Successful candidates will have experience and education in media, communications, PR or journalism as well as a deep understanding of blockchain, related technologies and issues within the industry.

Industries hiring analyst relations managers are ones where good PR is necessary for continued adoption of technology, such as government, banking and consumer technology.

Salary range

Who’s hiring

As the person who creates whatever it is the end user sees, a front end engineer puts the best possible face (and functionality) on a blockchain company’s customer platform. Programming experience is mandatory, and interface/UX/UI skills are a must. Specific programming languages will vary depending on the employer and its platform, but generally, blockchain front end engineers will need to be masters of ledger technologies and programming languages like JavaScript, Angular and Redux as well as HTML and CSS.

Educational requirements vary, but generally, degrees in computer science are helpful, though self-taught computer scientists with work experience in web and computer design and programming will be strong candidates.

Popular industries include currencies, lending and banking and healthcare.

Salary range

Who’s hiring

In an industry filled with legal and regulatory confusion, privacy issues and consumer protection statutes, as well as potential conflicts over intellectual property used to develop code and algorithms, lawyers are in huge demand in the blockchain industry. Blockchain lawyers don’t need to be programming experts, but they need to have or develop a deep understanding of the underlying technology and development processes so they can better protect their employers from legal trouble. Experience in mergers and finance law is helpful, too, as blockchain businesses are often targets for purchases by larger companies.

Successful candidates will need a law degree and license to practice, and most companies will heavily weight applicants with blockchain experience or years working for startups.

As regulatory and consumer privacy issues are central to any blockchain company, you likely can find employment in any field within blockchain.

Salary range

Who’s hiring

Using data science and business analytics tools, business analysts in blockchain measure effectiveness and efficiency of deployed products and recommend updates and improvements. These individuals also monitor and examine market trends to recommend the best positioning of the company and potential new products. Deep knowledge of data analysis tools and programming languages, such as Python, is necessary.

Particularly for senior roles, degrees in data or computer science will be needed, and experience with programming languages related to blockchain is helpful.

Most openings for business analysts in blockchain are likely to be in consumer-facing products, as those markets shift quickly.

Salary range

Who’s hiring

A key part of marketing and customer support, blockchain community managers maintain and develop their employers’ presence on social media, forums and other internet outlets as well as developing content appropriate to answer customers’ frequent questions. They also are responsible for reporting engagement statistics across all channels.While they won’t be in charge of programming their employers’ blockchain applications, they need a well of understanding about the product and underlying technology.

A marketing or PR degree likely won’t be necessary, but successful applicants won’t be entry-level individuals, as blockchain companies, which are likely to be startups, don’t have deep benches for these roles, so you’ll need to hit the ground running.

Consumer-facing industries, like banking, frequently hire in these roles, as do blockchain recruitment agencies.

Salary range

Who’s hiring

* Information on job openings, responsibilities, salaries and companies gathered from Indeed and Glassdoor in early January 2019

Despite a rocky 2018 in cryptocurrencies, the blockchain is alive and well, judging by investment in human capital.

In addition to the 300 percent increase seen on Glassdoor, freelance marketplace Upwork reported midway through last year that blockchain was the most sought-after skill by employers. Plus, blockchain companies are scoring major influxes of cash from venture capitalists, with blockchain and crypto startups boosting their VC investments by 280 percent in 2018.

Whether your skill set is in cracking out code or putting the company’s best foot forward, if you have a passion for blockchain and cryptocurrencies, there’s likely a company hiring near you now, and that trend is likely to continue through 2019.

My rates generally fall between .04 and .06 per word, depending upon the type of work, research involved, and volume. Volume discounts available.

Kindly contact me at jmpickett at gmail dot com, or call (210) 865-0742.

Highest Paying Finance Careers

The following article provides information about the most important aspects of a finance career. You will learn what finance professionals do, where they are employed, job duties, how to become one, popular career choices, and more.

Over the last several decades, the financial services sector of the economy has increased from 2.5% to 8.5% of national GDP. Today, financial professionals or financial managers are responsible for handling the financial health of organizations and individuals. Finance professionals focus largely on the production of financial reports, directing critical investment activities and devising effective, innovative strategies to enhance the long term financial health of an organization.

The role of the financial professional in the modern business world is evolving as advances in technology have greatly reduced the time that is required to generate financial data reports. Many financial professionals today in management are now doing more rigorous financial data analysis, as they offer senior level managers more specialized advice on how to increase profits and reduce waste.

Most finance professionals do some or all of the following:

There are many types of finance managers today; the type that you will be often depends upon your career goals and the size and scope of the organization.

Common types of financial managers include chief financial officers, controllers, credit managers, cash managers, risk managers, treasurers, and insurance managers.

Financial professionals can work in many types of business environments. For financial managers, we most commonly work in these areas below:

Financial professionals will not always be working just in New York, Chicago and Los Angeles today, either. According to Forbes magazine, there are many cities across America today that are adding more financial sector jobs than some of the biggest US cities.

While New York City will always be a major finance capital of the globe, other cities with a lower cost of living and higher economic growth are attracting more finance and finance related firms. In fact, since 2007, financial sector employment in New York City actually declined by at least 5%.

Some of the top cities in America seeing rapid growth in finance jobs are:

To work in the finance sector, you will need to have at least a bachelor’s degree in finance or business. To become a finance or financial manager, you will need to have several years of business experience in a financial, business or accounting related field.

To enjoy more opportunities in finance, it is recommended that you get your MBA in finance or accounting. Or, you can earn a Master of Science in Finance or Accounting.

Employment in the financial sector generally is going to increase by 8% by 2024, which is about as fast as average when weighed against other fields. In total, the finance field will add approximately 632,000 new jobs in the time period.

It seems that a more robust regulatory environment is driving demand for more finance professionals, accountants and auditors. Also, the economy is generally growing faster in the US. This is causing a business expansion which leads to more companies starting, and the growth of existing companies. These trends lead to more finance professionals being hired.

The median wage for all finance professionals in 2015 was $65,710. Finance professionals in some areas will earn a higher salary, especially if they have a graduate education.

There are many different career paths for professionals who want a finance career. Consider these popular finance career options:

Most finance professionals earn a bachelor’s degree in business, finance or accounting. It is strongly advised to have courses in finance, mathematics, investments, estate planning and risk management.

To work at a mid or senior level finance position, you should plan to earn your master’s degree in finance or accounting. Or, you can earn your master of business administration with a concentration in finance or accounting. Earning an MBA will provide you with a more rounded business management education. This may be beneficial if you want to work more generally in business management with a good knowledge of finance.

But if you want to work exclusively in finance, a master’s in finance would probably be ideal.

There are several types of finance that you should understand so that you can make the best career choice. The major areas of the business finance field are listed below. Which type of finance professional you want to be hinges upon in which of these areas you want to work the most:

There are many certifications that you can earn in the field of finance. Which you may want to earn depends upon the area of finance in which you work:

Millennials, those born between 1981 and 1996, are changing the US housing market. Millennials are mobile and tech-savvy, and have strong opinions on the types of houses they are looking for and at what price. It is a wise mortgage professional who learns this growing, important market segment. Learn more about how the housing market is changing with the growth of the millennial buying population in the article below.

Millennial Home Buyers – The Dominant Home Buying Demographic Today

Many mortgage brokers and real estate agents are unaware of just how large the millennial home buying market is today. It is estimated that millennials are now the largest group of home buyers, making up at least 34% of the market. And, they are 66% of first time home buyers. (Nationwidemortgages.net).

Millennials have become the overarching force in the US housing market. In 2016, Millennials associated owning a home with the American dream far more than other age groups:

According to 2016 data, most millennials expected to purchase a home within three to five years:

Millennials Proving to Be Tech Savvy Home Buying Researchers

Almost every millennial – 99% by some estimations – looked online when searching for a home. That compares to older baby boomers from 62-70 at 89%, and the silent generation at 77%. In all, 95% of American home buyers used the Internet to look for a home.

Also, millennials like to search for their dream home on mobile devices; 58% of this key age group used their smartphones to find a house, while Gen-Xers used smartphones 46% of the time, and younger boomers from 52 to 61 used them only 33% of the time.

Statistics further show that 76% of millennials did a driveby of a home because of an online advertisement they saw, and 64% of millennial potential buyers did a home walkthrough after they saw a listing online.

These young, savvy buyers used technology in January 2019, reports from Ellie Mae suggest, to refinance their home loans when rates dropped that month. Millennial refinances were at their highest rate since February 2018, and accounted for a whopping 13% of all closed loans. (MPAmag.com).

Millennials Trust Realtors

One of the most interesting findings of recent millennial home buyer surveys is now much they trust realtors to help them find their dream home:

They Want Homes Ready to Move Into!

Older Americans often do not mind buying a ‘fixer upper’ that needs some TLC before becoming their dream home. This does not describe the millennial home buyer. Most do not want to spend the money or time rehabbing an older, distressed property. They tend to purchase newly built homes to avoid issues with renovations, as well as electricity and plumbing problems. Surveys show 48% of millennials want to buy a new home, while only 34% of all buyers want the same.

Student Debt and High House Prices Are Major Obstacles

While the median household income for millennials is a healthy $82,000, they also are saddled with student loan debt.

According to Forbes, there is $1.56 trillion in student loan debt in the US. This has a major effect on the ability of millennials to buy their first home. Bankrate.com reports 31% of Americans to have student loan debt that is from their own education. Also, 13% of American adults have financed another family member’s school costs via student loans. Of people who responded to the Bankrate.com survey, 31% said they were delaying buying a home because of student loan debt.

Approximately 46% of millennials owe at least $25,000 in student loan debt, which is a monthly payment in many cases of $200 or $300. Millennials also say saving for that down payment as a first time home buyer with no equity in a current property is the biggest challenge.

Another major challenge for the millennial home buyer is that for those who are settling in major cities such as New York, Washington DC, Los Angeles, San Francisco or Boston, there is a high chance they are being priced out of these desirable but very expensive markets.

That said, some mortgage managers say that mortgage companies that provide better low money down mortgage programs could help millennials to become homeowners, and increase their market share in this incredibly important age demographic. There now are programs out there where you can put down less than 3% down.

Regarding student loan debt, there are conversations in Washington DC about how to put millennials in a better buying position. There are discussions about having only one government income based-repayment plan. Today there are five potential loan forgiveness programs of the remaining loan balance after 120 payments have been made. If you can see your student debt end by age 32, some finance experts say, you could see a scenario where you can possibly buy your first home faster.

Some Millennials Setting Off for Lower Cost Markets

While many younger home buyers are struggling with home affordability and student loans, a March 2019 report by CoreLogic shows that more millennials are heading off the beaten path of higher-priced markets on the coasts and going to Pittsburgh, Buffalo, Provo and Rochester, New York to find lower-priced homes. In these and other smaller metro areas in the middle of the country, buyers can get more house for their dollar. And because prices are lower and mortgages smaller, qualifying is easier. (Homebuyinginstitute.com).

CoreLogic analysis finds millennials make up a higher percentage of home buyers in smaller housing markets in the Midwest. On the other hand, there is a lower number of them in the country’s expensive coastal markets. This makes sense, as most millennials are buying for the first time and do not have equity from a previous sale to buy their new home.

CoreLogic analysis found the following markets had the highest share of millennial buyers. Realtors and mortgage brokers in these cities – pay close attention!

Data also showed that millennials are getting mortgages in states that border high priced markets. For example, millennial mortgage applicants from New York most often apply for mortgages in Pennsylvania and New Jersey. And applicants in California apply for mortgages in Nevada and Texas.

There is another reason that these smaller real estate markets are gaining cache with the millennial buyer: These markets are showing strong price growth in 2018 and 2019. For instance, the median home value in Pittsburgh rose by 10% over the last year, per Zillow data. That is well above the 7.2% rise across the country in the same 12 month period.

In Provo, the median home value spiked 17% over the last year. That is double the national average. It is expected the Provo real estate market will outpace the US overall through 2020, too. (homebuyinginstitute.com)

While Buffalo may not seem to be a ‘hot’ market, for millennials, you would be surprised. Prices in this upstate New York industrial city rose by double digits from 2018 to 2019. Millennial buyers looking for value will find them in Buffalo. Utica is another hot place for people in their 20s to buy a home, according to a new Realtor.com list. A major attractor for this upstate New York town is the low prices for homes; the median list price here is just $130,000, while nearby Albany has a median list price of $300,000. (uticaod.com).

Port St. Lucie in Florida is yet another affordable market that is attracting many millennial buyers. It is ranked in the top 10 nationwide for cities with the highest levels of millennial homeownership, according to SmartAsset. Fifty-three percent of these buyers in town own their homes. With average home prices a mere $175,000, Port St. Lucie is a good value for the young homebuyer. (wptv.com).

Millennials Plan Short Stay in First Home

Of all age demographics, millennials are the least likely to define homeownership as permanent. Many of them expect to eventually move and upgrade to a bigger and better home:

Also, 68% of millennials view their current home as a stepping stone to a better one they want in the future, compared to 36% of all buyers. Millennials keep their homes only an average of six years before selling, while all buyers keep their homes an average of 10 years before posting the For Sale sign.

What Home Features Millennials Like Best

When it comes to the features in their new digs, millennials have specific tastes, surveys suggest:

Summary

Data shows millennial home buyers are looking for newer homes with all the amenities, but also are sensitive to price due to not having a previous property to rely on for a down payment. Mortgage professionals who want to target the coveted millennial market would do well to focus on low down payment options offered via social media and other online advertising options. Target markets should be the hot, affordable ones in the interior US, where prices and mortgage amounts are reasonable for young people with student loan payments looming for a decade or more.

References

Utica Lands on Realtor.com List of Top Cities for Millennial Homebuyers. (2019). Retrieved from

Student Loan Debt Still Impacting Millennial Homebuyers. (2019). Retrieved from

Millennials Housing Market. (2019). Retrieved from

Millennial Home Buyers Flock to Affordable Markets. (2019). Retrieved from

Millennial Home Buyers Looking to South Florida and the Treasure Coast. (2019). Retrieved from

Millennial Homebuyers Milked January’s Low Interest Rates. (2019). Retrieved from

SEO stands for search engine optimization. SEO copywriting is essential for those who want to be highly ranked in major search engines for certain keyword phrases. What effective SEO copywriting does is: